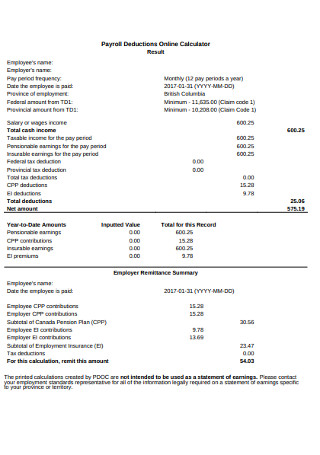

20+ ky payroll calculator

If payroll is too time consuming for you to handle were here to help you out. How much you pay in federal income taxes depends on the information you filled out on your Form W-4.

16 Consultant Invoice Templates Pdf Psd Google Docs Word Free Premium Templates

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

. Calculate your Kentucky net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state. The bonus calculator aggregate method The bonus calculator percentage method The 401k payroll calculator. The maximum an employee will pay in 2022 is 911400.

Important note on the salary paycheck calculator. How Your Kentucky Paycheck Works. Simply enter their federal and state W-4 information as.

It is not a substitute for the advice. Payroll pay salary pay check. This is the form that tells your employer how.

This free easy to use payroll calculator will calculate your take home pay. How to calculate annual income. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year.

We hope these calculators are useful to you. The GrossUp paycheck calculator. For example if an employee earns 1500.

The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and. The hourly paycheck calculator. When you choose SurePayroll to handle your small business payroll.

The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Kentucky residents only. Kentucky Payroll Tax Rates. Every first Saturday in May.

Kentucky Salary Paycheck Calculator. Back to Payroll Calculator Menu 2013 Kentucky Paycheck Calculator - Kentucky Payroll Calculators - Use as often as you need its free. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4.

Free Kentucky Payroll Tax Calculator and KY Tax Rates. Kentucky Hourly Paycheck Calculator. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Kentucky. Supports hourly salary income and multiple pay frequencies. To estimate a paycheck begin with the total annual salary amount in addition to divide by the particular quantity of pay durations in the year.

Pdf Ab Initio Calculations Of Mechanical Properties Methods And Applications

Hourly Paycheck Calculator Calculate Hourly Pay Adp

21 Sample Payroll Templates Calculators In Pdf Ms Word Excel

Pdf Baseline Cardiovascular Risk Assessment In Cancer Patients Scheduled To Receive Cardiotoxic Cancer Therapies A Position Statement And New Risk Assessment Tools From The Cardio Oncology Study Group Of The Heart Failure Association

Ac Tonnage Calculator Insert Sq Ft Get Tons Chart

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Financial Calculators Accupay Payroll Salary Hourly Wage

Paycheck Calculator Take Home Pay Calculator

Kentucky Paycheck Calculator Smartasset

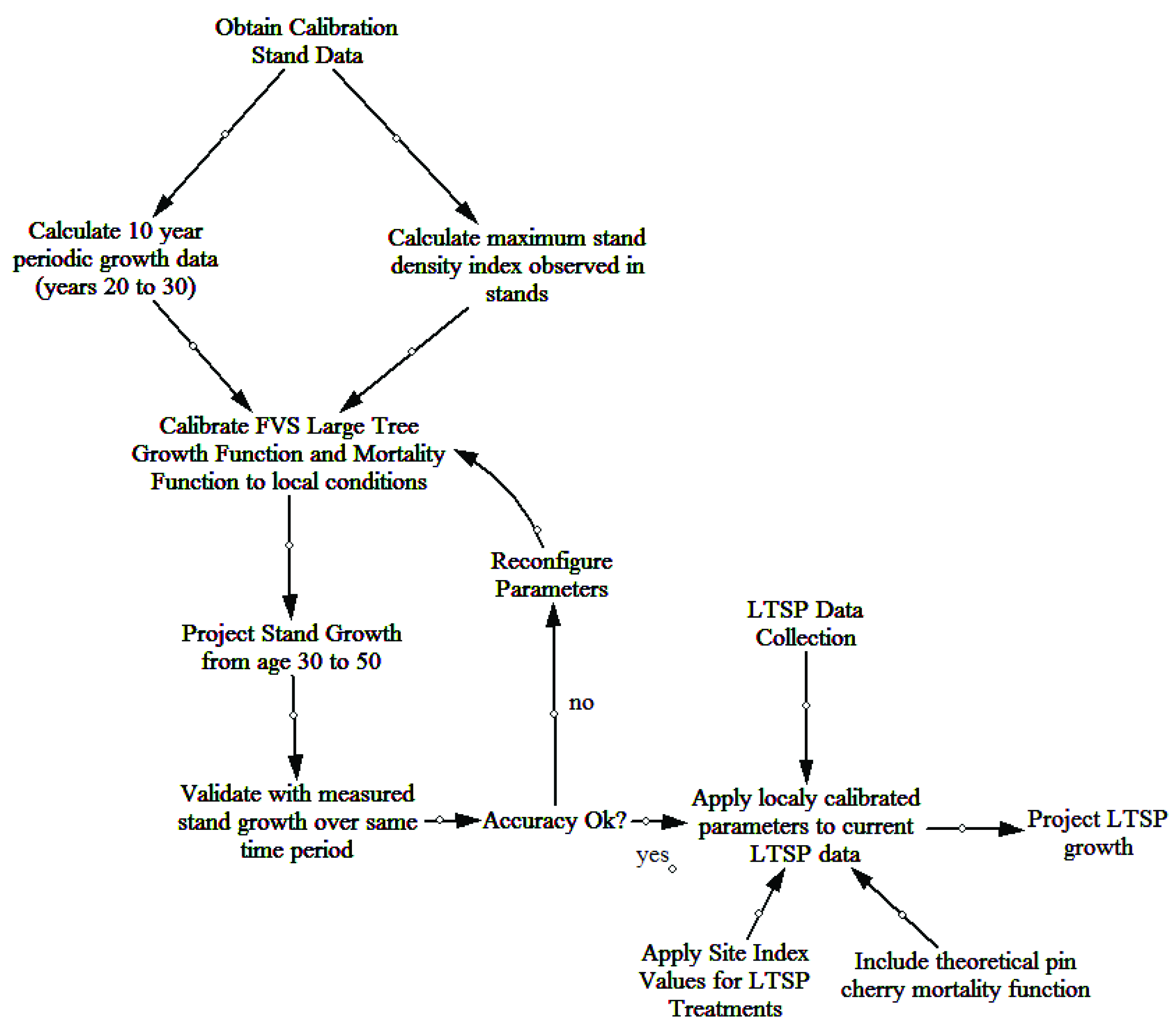

Forests Free Full Text Long Term Projection Of Species Specific Responses To Chronic Additions Of Nitrogen Sulfur And Lime Html

7th Pay Commission Calculator 2021 Updated Dec 2021 Govtempdiary

If Your Ctc Is Rs 40 Lpa What Do You Take Home After Taxes And Other Deductions Quora

Prepaid Items Mortgage Escrow Account How Much Do They Cost

If Your Ctc Is Rs 40 Lpa What Do You Take Home After Taxes And Other Deductions Quora

Hi This Is My Current Salary Structure Cam Anyon Fishbowl

How To Calculate Allowable Disposable Income For A Child Support Withholding Order

How To Calculate Allowable Disposable Income For A Child Support Withholding Order